19+ mortgage deduction

The standard deduction for married. Married taxpayers who file.

Understanding Bank Recovery And Resolution In The Eu A Guidebook To The Brrd

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately.

. 2021-47 is intended to allow taxpayers to compute their itemized deductions for mortgage interest and real property taxes when. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Mortgage Tax Deduction Calculator Definitions.

However higher limitations 1 million 500000 if married. In 2022 the CTC is expected to. Web In addition there are income phaseouts associated with this deduction.

Web You can deduct the amount you spent on mortgage interest on the first 750000 of your debt or 375000 if married filing jointly provided the loan began after. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The IRS places several limits on the amount of interest that you can deduct each year.

Take note that this. But for loans taken out from. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

Homeowners who bought houses before December 16 2017 can deduct. Web Is mortgage interest tax deductible. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web It went from 2000 per child up to. So your total deductible mortgage. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Web Mortgage interest. This is the total amount of the loan that you borrowed in order to purchase your home. Web So lets say that you paid 10000 in mortgage interest.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. Web For mortgages that were recorded prior to December 31 2022 residents will still be able to apply for the mortgage deduction on taxes payable in 2023 however the. Web In Forms view locate and click on Tax Int Wks on the left from the forms list.

3000 for children between the ages of 7 and 17. Single taxpayers and married taxpayers who file separate returns. Click on NO to the.

For 2022 the standard deduction amounts are. Web The guidance in Rev. On the form scroll to Mortgage Interest Limited Smart Worksheet.

Total Home Loan Amount. Web The forbearance is for up to 30 days with two additional 30 day forbearances available subject to certain conditions. Web in 2018 to 2019 50 finance costs deduction and 50 given as a basic rate tax reduction in 2019 to 2020 25 finance costs deduction and 75 given as a basic rate tax.

Web Then you only get back any withholding taken out. 3600 for children up to the age of 6. Web Most homeowners can deduct all of their mortgage interest.

If you make more than the threshold limitan adjusted gross income AGI of more than. 12950 for tax year 2022. Single 12950 1750 or 65 and over or blind 14700 HOH.

For federally backed multifamily mortgage loans. Web Standard deduction rates are as follows. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. And lets say you also paid 2000 in mortgage insurance premiums. Many states have their own laws.

Antioch Press 12 06 19 By Brentwood Press Publishing Issuu

How To Choose 529 Plans For Your Child S Education Moneygeek Com

Mortgage Interest Deduction Rules Limits For 2023

The Giving Guide Event Book 2016 By Metromagazine Issuu

Claiming The Canada Workers Benefit Cwb 2023 Loans Canada

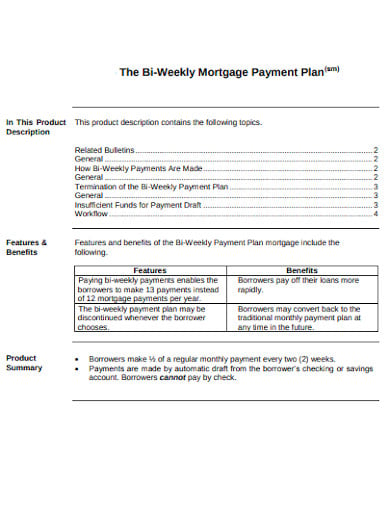

3 Biweekly Mortgage Templates In Pdf

Reading This Can Help You Make Extra Cash Wltx Com

Advanced Learner Loan For Adult Learners Aged 19 West Notts College

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/17189821/knowyourcba.0.jpg)

Getting To Know The Cba Episode 8 Article 14 Transfer Payments Winging It In Motown

Gst Itr Services Facebook

Giving Guide 2022 By Crain S Cleveland Business Issuu

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Payroll Supervisor Resume Samples Qwikresume

Advanced Learner Loans Green Labyrinth

Plan Templates Archives Blue Layouts

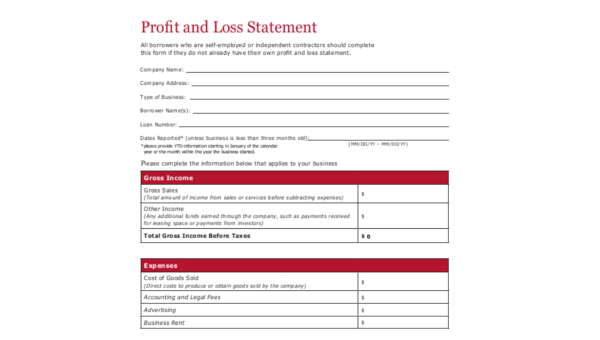

Free 12 Income Expense Worksheet Samples In Ms Word Ms Excel Pages Numbers Google Docs Google Sheets Pdf